Globalization vs. Internationalization vs. Localization: Learn more about these three different, but related ideas, and how each impacts your growing company.

Globalization, internationalization, and localization represent action items your business can kickstart to expand to different countries and regions of the world.

In this article, we’ll define each term and outline key differences and similarities. We’ll also encourage you to think about the benefits of thinking globally.

Understanding the differences between globalization, internationalization, and localization is key as you set out to take your company around the globe.

Defining Globalization vs. Internationalization vs. Localization

GILT is the acronym for globalization, internationalization, localization, and translation. These are the steps your company must walk through to gain traction around the world.

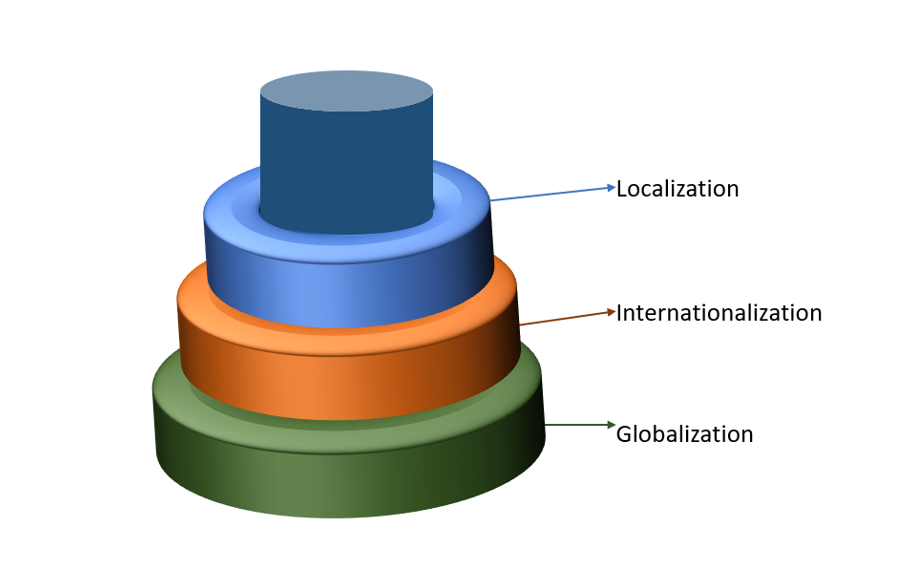

One way of differentiating these three concepts is to picture them as rings on a base. These rings increasingly get smaller and more focused the higher you reach.

At the bottom is the big-picture ring of globalization. That’s the procedures to follow and policies to adopt and adapt to so that your company can expand to the rest of the world.

Next, we have internationalization–the practice of designing products, services, and branding to facilitate expansion into international markets.

Finally, there’s localization—the adaptation of a particular product or service to a particular market.

They are all part of the same structure but build on one another to achieve the intended results.

To give you a better idea of what we’re talking about, let’s look at the definitions of each term.

Globalization

In relation to data and technology, globalization (g11n) represents the process of preparing your products and services so that they resonate around the world.

According to the World Health Organization, globalization is generally understood to include two inter-related elements:

- the opening of international borders to increasing flows of goods, services and technologies; and

- policies at national and international levels that facilitate or promote such flows.

It’s a big picture concept that covers a multitude of factors with respect to your business. It includes everything from where you can set up shop to the rules you must follow within that other countries and right down to software development and branding.

Here’s a few examples of successfully globalized companies to give you a better idea of what we’re talking about:

- With Amazon, you can easily purchase products from business and individuals located on different continents.

- Netflix operates in over 190 countries and offers different content in different regions.

- Airbnb features a universal symbol as its logo – the Belo – which symbolizes ‘belonging’, no matter where you are in the world.

Globalization therefore describes keeping the door open for your content, products, and services to adapt a worldwide audience. And this is just the starting point. Proper globalization further requires internationalization and localization.

Internationalization

Also known as i18n, this involves designing and developing your website, product, service, game, or application so they can be easily adapted for targeted markets that may vary in terms of culture, language, or region.

Internationalization is therefore a preliminary or preparatory stage that greatly helps the process of translation and localization.

Make the effort at the design and development stage to simplify the localization process. It’s worth it down the road.

Examples of Internationalization

A great example is the Starbucks logo update:

By removing the text from the logo, Starbucks moved to a logo design that can travel easily. It remains instantly recognizable around the world, but without the limiting English text that doesn’t cross borders as easily.

Or consider Kentucky Fried Chicken, the popular fast-food chain that rebranded to KFC in 1991. In the year prior, the state of Kentucky trademarked its name, meaning any company that used the word “Kentucky” for any commercial reason would have to pay the state a licensing fee.

Kentucky Fried Chicken became KFC, and they took the opportunity to introduce a complete redesign of their packaging and image along with the name change.

They joked it made it easier to say with one’s mouth full, but in reality, it allowed for a company name that was easier to say around the world, and took the focus off fried chicken to highlight some of the other options on the menu.

McDonald’s is another prime example. The popular fast-food chain has a presence in more than 100 countries including many in Asia, the Middle East, and Africa.

Their success lies partly in the recognizable golden arches, and a familiarity in terms of what you can expect when stepping inside. McDonald’s is famous for its uniform menu that features signature hamburgers and French fries.

Each of these American companies was created and built with local customer bases in mind, and whether through active planning or by law, they adapted over time and became more internationally friendly. thinking beyond your company’s original language and country, making it easier to adapt down the road and avoiding some potential headaches as a result.

Localization

Localization (l10n) refers to the adaptation of all your company’s parts to the linguistic and cultural standards of a given country or region. This applies to website content, mobile apps, branding, and the products and services you are providing.

Translation is only one part of the process. Localization is all about giving your company the look and feel of one that was built with the people who live in any given region in mind.

On top of offering your content, products and services in the local language or dialect, localization includes using local address and date formats, displaying the correct currency and units of measurement, choosing appropriate colors and graphics, and much more.

The Airbnb model

A standout example of successful of the benefits of localization is Airbnb. Based in San Francisco, they operate an online marketplace for lodging, primarily homestays for vacation rentals and tourism activities. They define localization as “deliberately creating products and services that are culturally appropriate, locally relevant, and globally consistent at scale.”

Airbnb was built with a global perspective in mind by offering a service where users can spend the night in privately owned dwellings hosted around the world.

To fulfill that mission, Airbnb must not only be available in the languages of their hosts and guests, it strives to respect cultural, legal, and local expectations, as well as “provide consistent experiences for people using it in their native countries and wherever their travels take them.”

They have a presence in approximately 200 countries and their website has been translated into over 60 languages. That translated content doesn’t just cover the listings and their accompanying information, but also user-generated content like user reviews and visitor guides for different regions.

This all requires both a highly localized product experience, and a high level of global consistency. So, for example, if you’re using Airbnb in Canada to book a trip to Japan, your experience using Airbnb should feel the same once you’re in Japan while also providing localized content for people who live there.

We’re lovin’ this

Let’s go back to the earlier McDonald’s example. As a result of their localization strategies, McDonald’s has been including locally relevant menus, and they constantly testing new products on an ongoing basis – vegetarian burgers in India, for instance. They focus on appealing to different cultures over different regions while banking on the familiarity of their brand.

Or consider AI powered virtual assistants like Google Assistant, Alexa, and Siri. These are all widely used by a significant percentage of the population for simple tasks they display a wide range of linguistic renditions and other cultural or behavioral settings.

A significant amount of data collection goes into rendering these devices serviceable in various regions of the world.

Here’s how the three stages are intertwined in this case:

- Globalization: a strategy for adding more language capabilities over time

- Internationalization: coding the assistants in such a way that they can easily switch between languages

- Localization: collecting data in different languages and dialects to train their speech recognition engines

Why GILT Matters for Your Company

Planning for these three stages at the outset will set you up for increased success. Here are a few reasons why the differences are worth knowing.

1. Enter New Markets More Easily

A global market should be considered from the ground level. That allows for easier transitions through the process of internationalization and localization.

Your company’s initial goal might not be to go international. But, why not think big and expect expansion down the road?

Remove barriers to global success so that you can easily gain traction in new markets much quicker. Then, you avoid cultural blunders along the way.

It might mean more work up front, but it keeps the door open for exponential growth.

2. Build a User-Friendly Website or App

With a global perspective in mind, your company’s website and accompanying app can help you reach a high number of prospective customers.

By limiting your company to a single language or geographic area, or by failing to code for international audiences, you are cutting it off from an abundance of revenue streams and limiting your ability to grow.

The more you adapt your infrastructure and marketing content to the cultural customs of a given region—or at least keep the door open to do so—the more you will increase the likelihood of your success.

3. You Can Grow Customer Base and Increase Revenue

Users will be able to better navigate and understand your website and app. So, they’ll be more likely to become a buyer—increasing your conversion rates.

And a satisfying customer experience will encourage not only repeat business, but also positive word of mouth.

Communicating with users in their language and considering cultural norms will go a long way towards establishing trust.

To bring it all full circle, localization will help you become more well established in different regions and therefore able to set up shop at various points around the world.

Get Started With GILT

Work with a globalization, internationalization, and localization partner that understands how to help you achieve global growth from the start.

Summa Linguae Technologies has helped businesses of all sizes navigate this terrain. Our data and localization solutions are highly adaptable to a company’s specific needs.

We help our global partners achieve the look and feel of a local company.