Cashless India, your e-wallet, e-payments, location-based access – all these words came with high search value when “demonetization” hit India like a wave.

The internet generation has already been using debit and credit cards for payments. Even with so many advancements, though, those modes of payment are still dealing with security-related issues.

The smartphone generation suddenly saw an explosion of digital e-wallet options. For example, there’s UPI or unified payment interface, Aadhaar based digital payment, USSD banking or *99# Banking, and e-wallets. The most popular options are Paytm, Momoe, PayUMoney, and State Bank Buddy to name a few.

As per a report Published by MediaNama on June 20, 2016, India has 27.3M credit cards; 739.3M debit cards as of October 2016.

However, these are primarily for users in the metros. The e-wallet were targeted for users from tier-II and tier-III towns. That’s especially true for those who do not have credit cards or even online banking facilities.

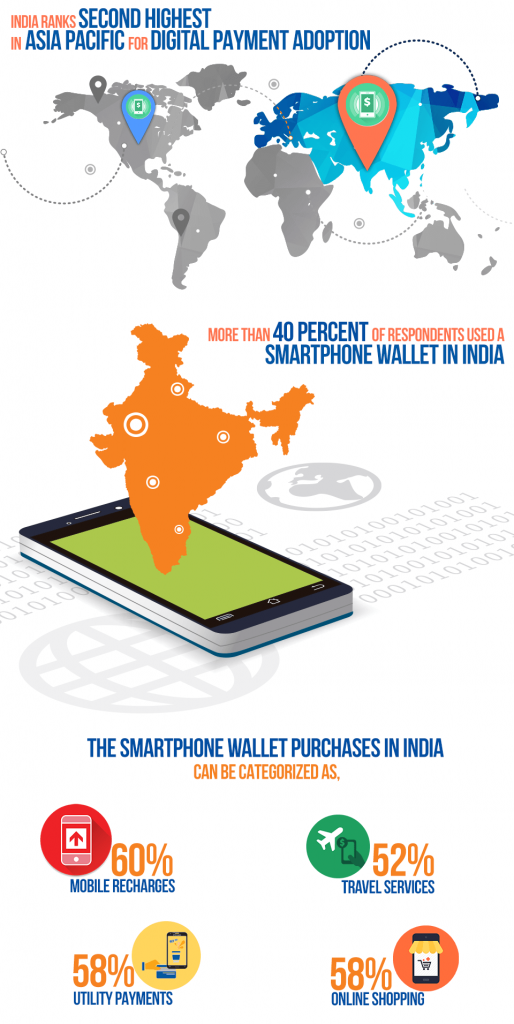

E-wallet Infographic

Credit: https://www.socialbeat.in/

Key Questions About the E-wallet

But this boom in the number of e-wallet options has to lead to the question of “customer loyalty”. In other words, how soon will this change from a push to pull business?

Consumer experience with respect to the UI/UX for all basic wallet features is important, but that might not be the game-changer. The answer lies in how secure and user-friendly the e-wallet can be.

E-wallet in E-commerce

Let’s look at e-commerce, for example. There are a few e-commerce giants who provide localized content. In other words, the product descriptions are available in different languages.

An e-wallet user, who in many tier-II and tier-III towns in India may not know English, selects his product by reading the translated content.

However, as they navigate to the payment gateway, they realize that it’s not available in the language of their choice. Since it’s a question of money and security, he abandons the transaction.

Now let’s assume that the payment gateway is also localized and the content is translated and available in multiple languages. This not only gives the consumer a seamless experience but also the feeling that the seller understands these pain areas and has acted accordingly.

This is why the translation of content is important for any e-wallet mode of payment to survive.

Security will always continue to be a major concern for any banking related transaction. Therefore, e-wallets should have a strong authentication mechanism, allow for face recognition, fingerprint and secure passwords.

As per a report by Business Insider, SBI blocked its users from transferring money to e-wallets using net banking due to phishing issues. That is why all e-wallets should provide clear guidelines on how to use their services and that too in a simple and easy to understand manner, which in many cases should be in the native language of the user.

Other important e-wallet security aspects:

- Download all e-wallets should only from the App store

- Don’t allow the launch and download of any additional third-party app.

- Makem the e-wallet available in combination with an anti-virus or anti-malware plug-in which protects the device.

- They should not launch advertisements as additional pop-ups.

- Mandatory log off after use.

For all of the above-mentioned aspects it is important to cater to the needs of the user including providing details in the language of the user.

User-generated feedback, which actually motivates downloads should be available in local languages. The app should be able to detect the preferred language of the customer and display the menu in that language.

What is essential for Indian languages is that the app, as well as the device, should be enabled with an OS to support these fonts.

Another pain area while using wallets is that people do not realize how much has been spent. There should be an option to include spending limits. This could also be linked to spending categories that help users plan their finances and spending limits.

What users also want are Offers and Loyalty rewards. Real-time information on relevant, location-based offers. Add loyalty points for using the wallet and not just any points, these points should be valuable and should influence the wallet user to use the wallet extensively.

How does the e-wallet affect the bottom line?

User experience, Security and Privacy, Offers and Loyalty programs and the option to view the information in the language of the consumer’s choice are factors that will help any e-wallet provider emerge as a leader in this rat race.

Consumers will select that mobile wallet service provider who is able to address their concerns in these areas along with providing the convenience and ease of usage.